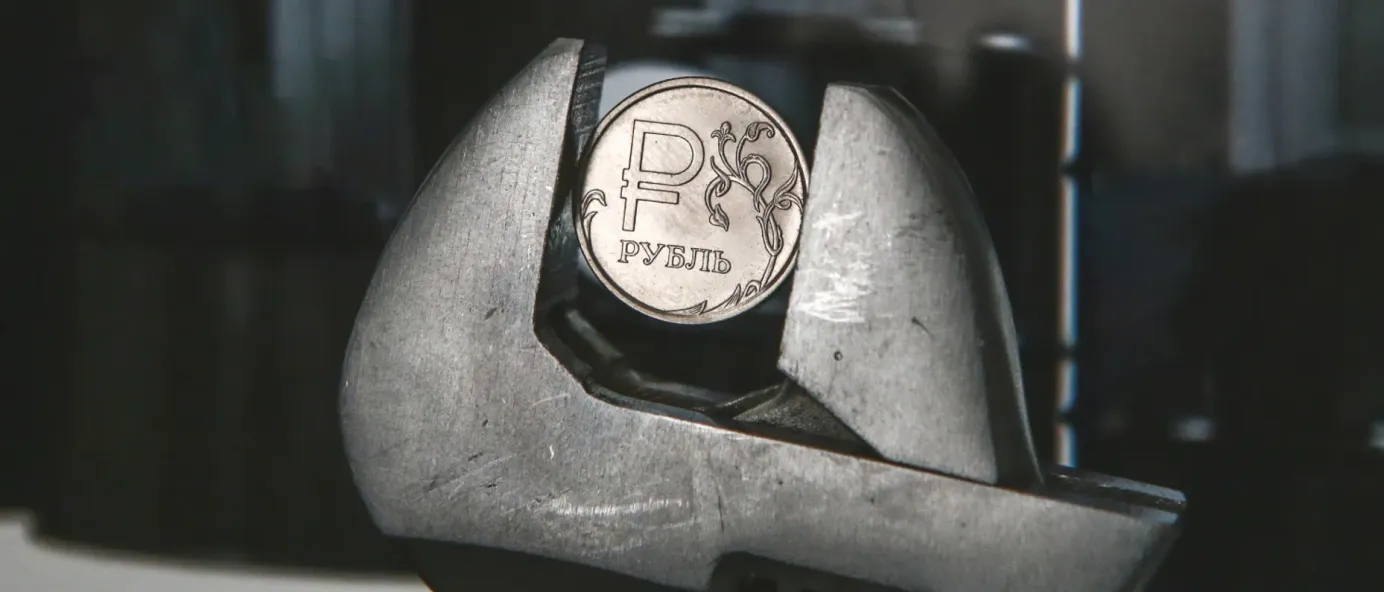

Rubel stabilisiert sich nach jüngstem Sanktionseinbruch

Der Rubel hat sich von einer plötzlichen Abwertung im vergangenen Monat erholt, die weitgehend auf Liquiditätsprobleme im Zuge der US-Sanktionen gegen Dutzende russischer Banken - vor allem die Gazprombank - zurückzuführen war. Der Wert der Währung hatte sowohl gegenüber dem Dollar als auch gegenüber dem Yuan, gemessen an verschiedenen Maßstäben, den niedrigsten Stand seit März 2022 erreicht.

- In den ersten Novemberwochen wurde der Rubel auf den Interbankenmärkten regelmäßig nahe der psychologisch wichtigen Marke von 100 gegenüber dem Dollar gehandelt. Doch nach dem 21. November, als die USA Sanktionen gegen den staatlichen Kreditgeber Gazprombank verhängten, der alle internationalen Zahlungen für russisches Gas abwickelt, stürzte er in eine neue Krise. Der Rubel wurde Tage nach dieser Entscheidung auf dem Interbankenmarkt mit 113 Rubel gegenüber dem Dollar und 119 Rubel gegenüber dem Euro gehandelt. An der Moskauer Börse (wo Dollar und Euro nicht mehr gehandelt werden) erreichte der chinesische Yuan 15 Rubel. Mehr über die Währungskrise können Sie hier lesen.

- Ende letzter Woche hatte sich der Rubel erholt, und der Dollarkurs kletterte wieder über die symbolische 100er-Marke. Der offizielle Wechselkurs, den die Zentralbank auf der Grundlage des Markthandels festlegt, wurde am Wochenende auf 99,4 Rubel festgesetzt. Der Kurs für den Euro, der sich ebenfalls auf den Interbankenhandel stützt, wurde auf 106,3 Rubel festgesetzt, und der Yuan wurde zu 13,5 Rubel gehandelt.

- Nach Ansicht russischer Experten wurde der Rubel dadurch gestützt, dass die Menschen den Kursrückgang nutzten, um ihre Vorräte an russischer Währung für die kommenden Monate aufzufüllen, sowie durch einen Rückgang der Spekulationsgeschäfte. Unterstützt wurde dies durch die Entscheidung der Zentralbank, einige Devisenkäufe bis zum Jahresende auszusetzen (normalerweise verkauft sie Rubel, um den Nationalen Wohlfahrtsfonds aufzufüllen, Russlands Sparschwein für überschüssige Öl- und Gasgewinne). Die Marktteilnehmer gehen davon aus, dass neue Mechanismen zur Bezahlung der Ausfuhren gefunden werden, und Wladimir Putin hat kürzlich die Vorschrift aufgehoben, dass ausländische Käufer alle Zahlungen für russisches Gas über die Gazprombank abwickeln müssen.

Warum sich die Welt darum kümmern sollte

Die zunehmende Volatilität des Rubels ist aufgrund der Sanktionen und der dadurch verursachten Ungleichgewichte sicherlich zu einem Problem für die russische Wirtschaft geworden. Es ist jedoch zu früh, die russische Währung zu begraben - die Moskauer Wirtschaftsbehörden verfügen über ausreichende Instrumente zur Stabilisierung und Stützung des Rubels.